Among its incubation tasks, the now defunct Maricopa Center for Entrepreneurship (MCE) distributed business loans funded by the City of Maricopa with a U.S. Department of Agriculture Rural Business Development grant.

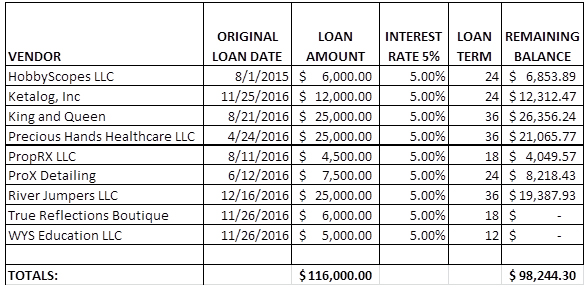

The loans totaled $116,000 at a 5 percent interest rate. Years later, more than $98,000 remains to be paid on the loans.

Nine fledgling businesses benefited from loan programs since 2015. Loans ranged from $4,500 to $25,000. The last loan was dispensed Dec. 16, 2016, to River Jumpers LLC.

The MCE was launched in 2013 as an incubator for start-up businesses and a resource for existing companies. It was seeded by a USDA grant of $50,000. Another $120,000 of city-maintained funds was spent that year on a management agreement with Northern Arizona Center for Entrepreneurship and Technology (NACET).

“It may have been a little bit before it’s time,” Mayor Christian Price said.

City Council fenced with three consecutive executive directors over how MCE reported its progress, its transparency and its accountability, including for business loans.

One qualifier for USDA loan candidates was that they had been turned down by a bank or other lending source. Low-interest business loans were an important part of MCE’s offerings since 2014.

Two businesses paid off their loans. Some businesses that obtained loans no longer exist and the loans remain outstanding. Others say they are pushing forward and working at paying back the loans.

Price said those results are the nature of incubating businesses just trying to get off the ground.

“As for repayment, that’s something we’re handling internally now,” said Cassandra Brown, the city’s grants coordinator.

The federally funded loans are in the City’s name, meant for MCE programs. Now the City and not MCE has the full task of tracking the loans. “We’re supporting these new businesses, and we’re actively working with these partners,” Brown said.

WYS Education and True Reflections Boutique had loans of $5,000 and $6,000 respectively, and both wiped them out in less than two years.

Several of the loan recipients no longer have functioning webpages and have not posted in social media in more than a year. In default or merely delinquent, four owe more than their original loan due to interest and fees.

HobbyScopes LLC was the first business to land an MCE loan, which was from a revolving loan fund (RLF) in 2015. As an RLF loan was paid off, the money went back into the program to fund more small-business loans. HobbyScopes’ loan was for $6,000, but the company struggled and still has a balance to be paid.

The next two recipients, Precious Hands Healthcare ($25,000) and ProX Detailing ($7,500), have had varying success paying down their loans.

In 2016, though still questioning MCE’s accountability for the loans, City Council unanimously approved up to $200,000 for MCE expenditures. Shortly after, NACET fired the executive director, Dan Beach. Last fall, the city council effectively fired NACET, and MCE closed in spring.

Price said that allowed the city to take a step back and find a different use for money it had dedicated to MCE.

“We’ve taken those funds and beefed up our Economic Development Department and reallocated it to other departments,” the mayor said.

Price said an incubator is still a good idea for Maricopa but will probably change the approach for “growing an economic garden.”

“We’ll probably focus more on partnerships and stair-step it up,” he said. “I envision we’ll have one in the future. I just don’t know when that future will be.”

Multiple attempts to reach loan recipients for comment were unsuccessful.

HobbyScopes LLC

Research-quality microscopes for hobbyists and children

Ketalog, Inc.

Advertising, apps and analytics

K&Q Clothing

Men’s and women’s clothing and accessories

Precious Hands Healthcare LLC

Home healthcare services

PropRX LLC

Property cleanup, preservation and house watch

ProX Detailing & Auto Glass

Auto detailing, washing, tinting, windshield repairs and replacement

River Jumpers LLC

Inflatable bouncers, waterslides, rock walls and other party accessories

True Reflections Boutique

Shop-from-home women’s clothing and accessories

WYS Education LLC

Write Your Story, for self-realization, insight and inspiration

This story appears in the August issue of InMaricopa.

![Who’s the Best Mom InMaricopa? Nominate now! Marlene Marshall, Christina Olivares, and Meghan Bremer. [Bryan Mordt]](https://www.inmaricopa.com/wp-content/uploads/2023/05/BCM_8465-218x150.jpg)

![Alleged car thief released without charges Phoenix police stop a stolen vehicle on April 20, 2024. [Facebook]](https://www.inmaricopa.com/wp-content/uploads/2024/04/IMG_5040-218x150.jpg)

TRUE FACT About MCE Loan Program Revealed! By Dan Beach

I have been living in Maricopa for the past 3 years – shopped here, worked here, volunteered almost weekly at the Maricopa Pantry. I very much DENY the report that I was contacted for comment. FAKE NEWS. I resent the implication that I was fired because of the loan program or any other financial improprieties.

When I was Director of MCE, I worked closely with City officials, the Mayor, the Council, and the Editors and Publishers of inMaricopa. I was surprised by the lies and inuendoes in the article.

Here are some of the facts you seemed to overlook in the quest for your “story.”

1. The Maricopa entrepreneur loan program was created with a seed money GRANT from the USDA. The City of Maricopa is NOT “on the hook” for any of the money. Any repayments were to be used to further the loan program.

2. MCE did not operate the loan program. While MCE assisted in preparing the very simple loan requests with the entrepreneurs; MCE was not responsible for the decision making, funding, or servicing of the loans.

3. The loan program was specifically designed to assist entrepreneurs who could not get loans from other sources because they didn’t meet the necessary criteria. Had I continued at MCE, I would have assisted the businesses to repay their loans and would have assisted the City in servicing them.

4. I was fired because NACET who ran MCE for the City wanted to end their relationship with the City. The loans had only begun when I was fired. I was NOT fired for cause or other financial issue.

5. The annual budget of $200,000 was not a part of the loan program and was money well spent helping local entrepreneurs, businesses, and non-profits. While I had access to a part of that budget for programs, the budget was controlled by NACET.

6. I am proud of the work we did at MCE – we assisted hundreds of entrepreneurs. We provided detailed records of the amount of training, number of businesses assisted, number of business outreaches we developed and our successes. Several of the on-going business events – marketplace, food truck events, art gallery and art events had their beginnings through MCE.

I’ll answer your concluding questions:

The City of Maricopa needs an MCE – a connecting and unifying group for the hundreds (maybe thousands) of entrepreneurs, individuals, and small businesses operating in or through the City. Most of those businesses are invisible because they work from garages and living rooms, operate virtually, or do their business primarily outside of the City. These businesses owners need connections for marketing and sales, they need training in the areas of their weaknesses, and they need a go-to place for answers.

I agree with my friend Mayor Nancy Smith — a private-public partnership would likely work best. I believe the City needs to take the lead in making that happen. And I think that doing so might be reflected in a greater amount of sales tax being acknowledged, collected and distributed to the City.