The Pinal Regional Transportation Authority voted Monday to work toward placing a new funding mechanism on the November ballot to replace the measure invalidated last week by the Arizona Supreme Court.

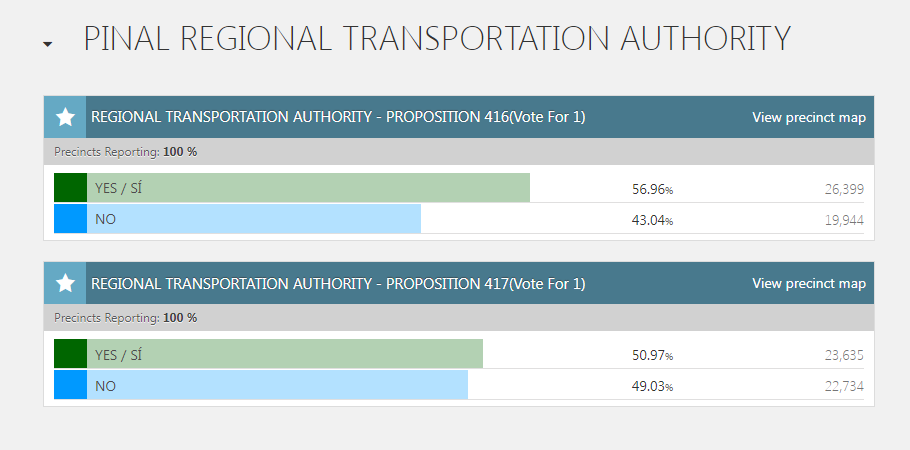

The proposition vote would decide a single issue – whether Pinal County voters want to continue the half-percent transportation sales tax they have been paying since 2018. That tax was proposed in Proposition 417 which passed by a margin just shy of 51%.

But the tax was invalidated by a split decision of 4-3 by the Supreme Court because it was set up as a two-tiered excise tax – a half-percent on the first $10,000 of a retail purchase and a zero percent tax on any portion over $10,000. The court ruled it was illegal for a county to impose a tax structured in that manner. The new tax would be levied on all such purchases.

The companion transportation plan that was Proposition 416 can remain in place. That plan identified the priorities for the sales tax revenue and included four primary projects:

• Widening and improving State Route 347 between Maricopa and Interstate 10

• Building the Sonoran Desert Parkway (formerly known as the East-West Parkway) to connect the southern end of Maricopa with I-10

• The North-South Corridor, which would run down the eastern part of the county from U.S. 60 through San Tan Valley, between Coolidge and Florence, and link with I-10 between Eloy and Picacho

• Moving forward to build Interstate 11.

That proposition, which passed by a margin of slightly less than 57% of the vote, was upheld by the state Supreme Court.

If approved, the Arizona Department of Revenue would begin collecting the tax in April 2023 and it would last for 20 years. According to Casa Grande Mayor Craig McFarland, who chaired the meeting, the expanded sales tax would raise significantly more revenue than the plan implemented in 2017.

“If indeed the voters do, in fact, authorize a new tax, that would leave the PRTA in place, implement the half-cent sales tax for 20 years to fund the kinds of projects that were defined in the 2017 plan and we believe estimates are that those funds would be in excess of $1 billion, roughly $340 million more than the estimate that was included in the 2017 plan,” McFarland said.

McFarland said there are four steps upcoming for the county. The first is to notify ADOR that the county has abandoned its position on the tax and won’t pursue legal action. It will give PRTA staff and legal counsel direction to work with ADOR to find out how the revenue department will handle the $82 million in funds collected to date.

It will also prepare a resolution to the county to address the legal deficiencies in the old tax and place the tax back on the Nov. 8 ballot.

Finally, the PRTA will retain a financial consultant to provide recommendations on how the estimated $340 million in additional funds will be allocated and provide the group with cost projections for the above actions.

![Alleged car thief released without charges Phoenix police stop a stolen vehicle on April 20, 2024. [Facebook]](https://www.inmaricopa.com/wp-content/uploads/2024/04/IMG_5040-218x150.jpg)

![Locals find zen with Earth Day drum circle Lizz Fiedorczyk instructs a drum circle at Maricopa Community Center April 22, 2024. [Brian Petersheim Jr.]](https://www.inmaricopa.com/wp-content/uploads/2024/04/PJ_3922-Enhanced-NR-218x150.jpg)

![Alleged car thief released without charges Phoenix police stop a stolen vehicle on April 20, 2024. [Facebook]](https://www.inmaricopa.com/wp-content/uploads/2024/04/IMG_5040-100x70.jpg)

![Locals find zen with Earth Day drum circle Lizz Fiedorczyk instructs a drum circle at Maricopa Community Center April 22, 2024. [Brian Petersheim Jr.]](https://www.inmaricopa.com/wp-content/uploads/2024/04/PJ_3922-Enhanced-NR-100x70.jpg)