City Manager Rick Horst often speaks of doing more with less, which allows the city council and staff to stretch their budgets and give taxpayers more bang for their buck.

Proof of that fiscal philosophy can be seen in the city’s draft budget for the coming fiscal year. The city will cut taxes for the second consecutive year and wind up with a budget surplus of more than $7 million.

But while the city is decreasing the property tax rate, homeowners still should expect to pay more in property taxes due to the huge rise in the value of homes in the city over the past year. The tax cut will mitigate that increase, however.

The city’s increased revenues and reduced expenses will leave a budget surplus of $7.7 million this fiscal year, up from $84,599 last year. The total operating budget for FY 2021/2022 is $62.5 million, up from $55.7 million.

The preliminary budget for fiscal 2021-2022 recommends a three-pronged tax cut, reducing both the primary and secondary property tax rates for the coming year and eliminating a county Fire Bond tax.

“Over the past three years, we have worked to position our city for future possibilities, and now is the time to begin the harvest,” Horst said in a letter to council. “Coming off our best, post-recession year, we stand poised to have the most noteworthy year in our city’s history. Maricopa is positioned to see significant retail and employment center growth over the next 3-5 years and can place itself to take full advantage of these opportunities with a partnership approach to enable the leveraging of private investment.”

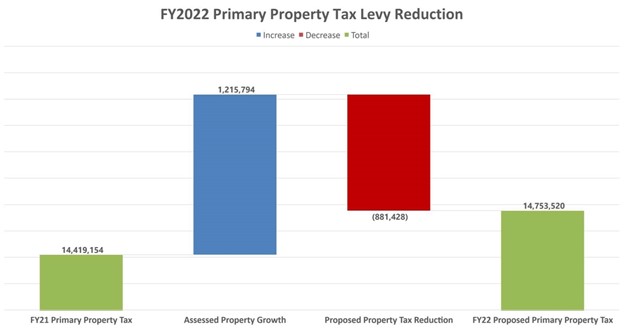

The city collected $14.4 million in property taxes in the current fiscal year, which ends June 30. The city’s assessed property values grew by $1.2 million. That growth enables a reduction of the tax rate from 4.63% to 4.37% but increases property tax revenues by more than $330,000, to $14.8 million. Horst said the strategy comes not only from council and staff, but from the will of the taxpayers.

“We are self-assured in our capacity to control resources and manage change,” Horst said in his letter. “The demand for more services and reduced taxes remains the standard-bearer. We listened, we heard, and we are proud to state that our FY 2021/2022 budgeted expenditures are less than the previous year. Doing more with less…it is a thing.”

The primary property tax is a limited tax levy used for general government operations based on the primary assessed valuation and the primary tax rate. The total levy for primary taxes cannot increase by more than two present per year, plus allowances for annexations, new construction, and population increase.

The secondary property tax is dedicated to repayment of the city’s general bond debt obligations. All property taxes are deposited into the city’s general fund.

Assistant City Manager Jennifer Brown explained how staff determined the size of the cuts.

“The city performed an analysis forecasting specific revenue streams and calculated how much should go back to the citizens while maintaining appropriate revenue volumes for the growing infrastructure and capital investment needs of the city,” she said. “We did this while also reducing forecasted operating expenditures.”

This is possible for several reasons. Maricopa’s population is growing, and more homes are being built, broadening the tax base. Moreover, home values are skyrocketing, increasing assessed value. This creates a scenario in which the city has a broader and deeper tax pool, allowing it to reduce the tax rate and still increase overall tax revenue.

Brown said that while those factors certainly contribute to the rate reduction, they are only part of the reason.

“The other part of the story is that we are doing more with less,” she said “In the current draft of the recommended budget, operating expenses are down more than $800,000 from last year and that includes giving staff their annual increases and adding some necessary additional staff members to accommodate for the growth of the city. This is done by our staff thinking outside the box on how to work more efficiently and effectively and a true testament to their ingenuity.”

Residents would see a total property tax rate cut of 0.3144 percent. The elimination of the county Fire Bond tax cuts rates about another 0.10 percent, leaving a total tax reduction of 0.4097 percent. That rate reduction equates to a savings of $94.32 for residents whose home is valued at $300,000.

![Elena Trails releases home renderings An image of one of 56 elevation renderings submitted to Maricopa's planning department for the Elena Trails subdivison. The developer plans to construct 14 different floor plans, with four elevation styles per plan. [City of Maricopa]](https://www.inmaricopa.com/wp-content/uploads/2024/04/city-041724-elena-trails-rendering-218x150.jpg)

![Affordable apartments planned near ‘Restaurant Row’ A blue square highlights the area of the proposed affordable housing development and "Restaurant Row" sitting south of city hall and the Maricopa Police Department. Preliminary architectural drawings were not yet available. [City of Maricopa]](https://www.inmaricopa.com/wp-content/uploads/2024/04/041724-affordable-housing-project-restaurant-row-218x150.jpg)

![City looks to lower property taxes again City Manager Ben Bitter speaks during a Chamber of Commerce event at Global Water Resources on April 11, 2024. Bitter discussed the current state of economic development in Maricopa, as well as hinting at lowering property tax rates again. [Monica D. Spencer]](https://www.inmaricopa.com/wp-content/uploads/2024/04/spencer-041124-ben-bitter-chamber-property-taxes-web-218x150.jpg)

![Shred-A-Thon to take place tomorrow An image of shredded paper. [Pixabay]](https://www.inmaricopa.com/wp-content/uploads/2024/03/shredded-paper-168650_1280-100x70.jpg)