Maricopa’s property tax as we now know it started in 2006 when residents voted in favor of Proposition 400, a referendum that would allow the city to collect a property tax to fund municipal fire and police departments.

The new tax replaced a secondary property tax levied by the Maricopa Fire District. On average, it saved taxpayers around $400 per year.

Maricopa voters supported the measure overwhelmingly, voting 578-39 in favor.

The city added a secondary property tax in 2010 when it issued a $20 million bond package to construct a regional recreational complex, later named the Copper Sky Multigenerational Center. The development included an eight-lane, 25-yard lap pool with diving boards, leisure pool, water slide, lazy river, splash pad and rock-climbing wall.

The regional park opened in March 2014. The pool and aquatic center opened Memorial Day that same year.

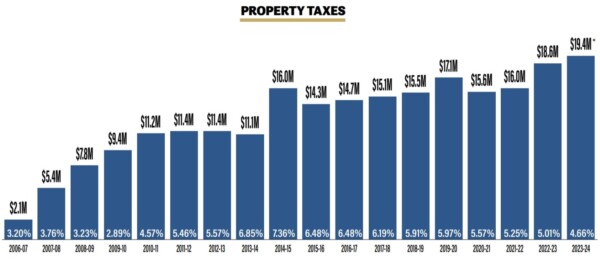

As housing values decreased during the Great Recession, property tax rates increased with the 2014-15 fiscal year at a combined rate of 7.36%.

Over the last five years, the rate has dropped four times, with the latest combined rate standing at 4.66% — the lowest since it was 4.57% in the 2010-11 fiscal year when the secondary tax was first collected.

The October edition of InMaricopa Magazine is in Maricopa mailboxes and available online.

![City gave new manager big low-interest home loan City Manager Ben Bitter speaks during a Chamber of Commerce event at Global Water Resources on April 11, 2024. Bitter discussed the current state of economic development in Maricopa, as well as hinting at lowering property tax rates again. [Monica D. Spencer]](https://www.inmaricopa.com/wp-content/uploads/2024/04/spencer-041124-ben-bitter-chamber-property-taxes-web-218x150.jpg)

![3 things to know about the new city budget Vice Mayor Amber Liermann and Councilmember Eric Goettl review parts of the city's 2024 operational budget with Mayor Nancy Smith on April 24, 2024. [Monica D. Spencer]](https://www.inmaricopa.com/wp-content/uploads/2024/04/spencer-042424-preliminary-budget-meeting-web-218x150.jpg)

![Alleged car thief released without charges Phoenix police stop a stolen vehicle on April 20, 2024. [Facebook]](https://www.inmaricopa.com/wp-content/uploads/2024/04/IMG_5040-218x150.jpg)

![City gave new manager big low-interest home loan City Manager Ben Bitter speaks during a Chamber of Commerce event at Global Water Resources on April 11, 2024. Bitter discussed the current state of economic development in Maricopa, as well as hinting at lowering property tax rates again. [Monica D. Spencer]](https://www.inmaricopa.com/wp-content/uploads/2024/04/spencer-041124-ben-bitter-chamber-property-taxes-web-100x70.jpg)