If you know the rules of the game, you will win the game. With credit, the rules are not easy to understand because of the many algorithms used to score a person.

1. Payment History

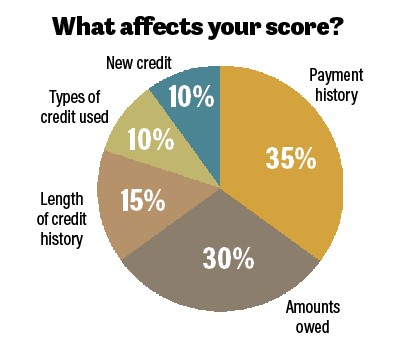

Your payment history—whether you pay your bills on time or not—is the single biggest factor in your credit score and accounts for 35% of your score. All three credit bureaus hold payment history information on each of your accounts.

If you repay your debts on time, lenders consider you a better risk.

2. Amount Owed

The second-largest credit score factor is credit utilization. How much of your available credit you use accounts for 30% of your score, generally speaking, credit utilization refers to revolving debt—credit cards, store cards or home equity lines of credit, for instance—rather than fixed loan debt.

Try not to use over 30% of your available credit. Whatever you do, don’t max out your cards.

3. Credit Age

Your credit age is based on the age of your oldest account. The older your credit, the more robust this part of your scoring model will get. You don’t have too much control over your credit age, so it only accounts for 15% of your FICO score.

One of the most important things you can do to keep your credit age solid is to not close older accounts. Lenders like to see that you have a long history of responsibly managing your credit accounts.

4. Types of Credit

Lenders like to see evidence you can handle numerous types of debt, and that is why credit mix is part of the FICO picture. Credit mix—the number of different credit cards, personal loans and other kinds of debt you hold—makes up 10% of your FICO score.

Strictly speaking, there is no ideal credit mix, but it won’t hurt to hold a couple of different types of accounts. If you are looking to boost your score, focus on credit utilization and payment history before credit mix.

5. Credit Inquiries (New Credit)

New credit inquiries make up about 10% of your credit score. In simple terms, every time you make a new credit application for revolving or installment credit, potential lenders pull your credit report. This is called a hard inquiry, which is documented to keep track of how actively you shop for credit.

Hard inquiries aren’t the same as soft inquiries. Soft inquiries happen when you pull your own credit, or when lenders pre-screen or pre-qualify you for credit offers. They don’t make an impact on your credit score at all.

Jimmy or Sylvia Rios live in Maricopa and can be reached at 480-935-6049, 480-341-2901, [email protected] or [email protected]. Their website is NextLevelCredit.net.

This sponsored content was first published in the July edition of InMaricopa magazine.

![Elena Trails releases home renderings An image of one of 56 elevation renderings submitted to Maricopa's planning department for the Elena Trails subdivison. The developer plans to construct 14 different floor plans, with four elevation styles per plan. [City of Maricopa]](https://www.inmaricopa.com/wp-content/uploads/2024/04/city-041724-elena-trails-rendering-218x150.jpg)

![Affordable apartments planned near ‘Restaurant Row’ A blue square highlights the area of the proposed affordable housing development and "Restaurant Row" sitting south of city hall and the Maricopa Police Department. Preliminary architectural drawings were not yet available. [City of Maricopa]](https://www.inmaricopa.com/wp-content/uploads/2024/04/041724-affordable-housing-project-restaurant-row-218x150.jpg)

![Silk Press Xpress ready to welcome new clients Maricopa Chamber of Commerce Director Kelly Anderson and Councilmember Henry Wade smile as LaQuinta Fisher cuts the ribbon in front of her new salon, Silk Press Xpress, on April 6, 2024. [Monica D. Spencer]](https://www.inmaricopa.com/wp-content/uploads/2024/04/spencer-040624-silk-press-xpress-ribbon-cutting-web-01-218x150.jpg)

![Alleged car thief released without charges Phoenix police stop a stolen vehicle on April 20, 2024. [Facebook]](https://www.inmaricopa.com/wp-content/uploads/2024/04/IMG_5040-218x150.jpg)

![City gave new manager big low-interest home loan City Manager Ben Bitter speaks during a Chamber of Commerce event at Global Water Resources on April 11, 2024. Bitter discussed the current state of economic development in Maricopa, as well as hinting at lowering property tax rates again. [Monica D. Spencer]](https://www.inmaricopa.com/wp-content/uploads/2024/04/spencer-041124-ben-bitter-chamber-property-taxes-web-100x70.jpg)

![3 things to know about the new city budget Vice Mayor Amber Liermann and Councilmember Eric Goettl review parts of the city's 2024 operational budget with Mayor Nancy Smith on April 24, 2024. [Monica D. Spencer]](https://www.inmaricopa.com/wp-content/uploads/2024/04/spencer-042424-preliminary-budget-meeting-web-100x70.jpg)