It is possible to obtain a mortgage after bankruptcy.

In fact, it may be easier to get a mortgage after bankruptcy than other forms of credit. Many prospective homeowners who have a bankruptcy on their credit jump onto a high rate home loan. However, if you can wait 24 months after you case has closed, you can usually qualify for an FHA loan.

When you get a mortgage after bankruptcy, you should be very careful about the cost of the house you are purchasing. A house payment that is too big may be just a recipe for another bankruptcy. If you have already been through a bankruptcy, you know how hard it is to try to make ends meet when they don’t.

A mortgage payment that leaves you overextended may mean you will not have money for other things, such as retirement, college funds, vacations and emergency purchases. It can also leave you vulnerable to another bankruptcy and foreclosure. You should not rely upon your mortgage loan officer or real estate agent to guide you into an affordable purchase.

Getting a mortgage is your decision, and the right decision will help keep you away from a second bankruptcy. Do not be pushed into buying more of a house than you can really afford; it is your finances, and it is you who will be obligated to make the payments.

When you are obtaining a mortgage after a bankruptcy, you should keep three things in mind: the lending industry, inflation and the two income couples.

* The lending industry of our parent’s generation is gone. Years ago it was hard to get a mortgage. Today, most anyone can obtain a mortgage, and lenders will give you a loan even if they know it will trash your finances.

* Inflation is on the rise, and income is not.

* You should not base the price of the house you are purchasing on two incomes. If one of the breadwinners in the family became ill, what would you do? Purchase a house that is affordable if only one of the individuals in a couple were working.

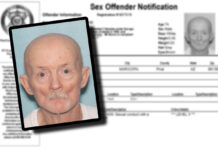

File photo