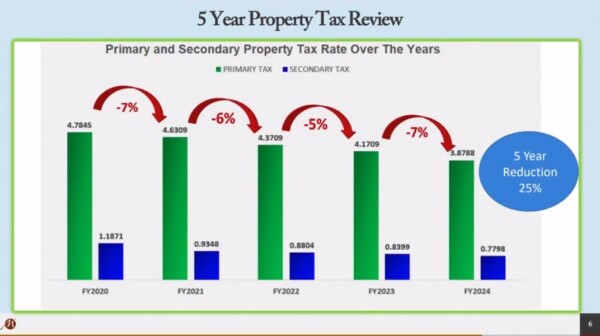

Maricopa announced its fifth property tax rate reduction in as many years at the city council’s May 16 meeting. Residents will see their 2024 primary property tax drop to 3.87%, a small but welcome reduction from 2023’s 4.17% tax rate. The secondary rate dropped to 0.78% from 0.84%.

“Let’s get right to the good news,” read Matt Kozlowski, deputy city manager and chief financial officer, from the budget transmittal letter. “Our budget is balanced, requiring no new taxes or reliance on reserves and allows us to continue lowering taxes.”

The news earned applause from the audience and accolades from the city council.

“Our citizens should be very proud of the fact that we do live within our means,” said Mayor Nancy Smith. “We have a balanced budget, and we live within our means.”

Councilmember Vincent Manfredi agreed, highlighting the city’s attempts to be fiscally responsible.

“As a city, we have worked really hard to make sure our expenses are not rising as fast as the inflation you see around the country and I’m proud,” Manfredi said. “It’s not that we’re spending less, it’s that we’re spending smarter. We’re being good stewards of the taxpayers’ money.”

2023 revenue from primary property taxes was $15.3 million, and 2024 revenue is projected to reach $16.1 million. Kozlowski said revenue generated from new construction accounted for the tax rate reduction.

Editor’s note: Councilmember Vincent Manfredi is an owner of InMaricopa.

![The Maricopa City Council, from left: Vice Mayor Vincent Manfredi, Councilmembers Bob Marsh and Henry Wade, newly appointed Mayor Nancy Smith, and Councilmembers Amber Liermann and Rich Vitiello. A seventh councilmember will be appointed. [Bryan Mordt]](https://www.inmaricopa.com/wp-content/uploads/2022/08/BCM_9932-2-1-scaled.jpg)

![City gave new manager big low-interest home loan City Manager Ben Bitter speaks during a Chamber of Commerce event at Global Water Resources on April 11, 2024. Bitter discussed the current state of economic development in Maricopa, as well as hinting at lowering property tax rates again. [Monica D. Spencer]](https://www.inmaricopa.com/wp-content/uploads/2024/04/spencer-041124-ben-bitter-chamber-property-taxes-web-218x150.jpg)

![3 things to know about the new city budget Vice Mayor Amber Liermann and Councilmember Eric Goettl review parts of the city's 2024 operational budget with Mayor Nancy Smith on April 24, 2024. [Monica D. Spencer]](https://www.inmaricopa.com/wp-content/uploads/2024/04/spencer-042424-preliminary-budget-meeting-web-218x150.jpg)

![Alleged car thief released without charges Phoenix police stop a stolen vehicle on April 20, 2024. [Facebook]](https://www.inmaricopa.com/wp-content/uploads/2024/04/IMG_5040-218x150.jpg)

![City gave new manager big low-interest home loan City Manager Ben Bitter speaks during a Chamber of Commerce event at Global Water Resources on April 11, 2024. Bitter discussed the current state of economic development in Maricopa, as well as hinting at lowering property tax rates again. [Monica D. Spencer]](https://www.inmaricopa.com/wp-content/uploads/2024/04/spencer-041124-ben-bitter-chamber-property-taxes-web-100x70.jpg)

so tax rate decreased but did the assessement go up? pls answer if douglas wolf pinal county assessor increased assessement? need answers

Well that’s nice but honestly too bad no one will even see it. With Pinal County raising taxes at 10% that will just mean the tax decrease will be negated. From the tax statement I have 10% increase again this year, same as last year, year before, year before.. lol good ole taxes they giveth and taketh away just as fast.