When you drive up and down John Wayne Parkway, businesses are packed with customers. Traffic is bumper-to-bumper.

Everywhere you look, it’s a beehive of economic activity.

That’s impressive when you consider in 2003 Maricopa’s population was only around 2,000 residents.

Now it’s a bustling city of more than 70,000.

According to U.S. Census figures, nearly 6,000 people move to Maricopa each year.

As popular as Maricopa has become these days, it wasn’t always the case.

Maricopa was the perfect example of a Wild West boom town in its early years as a city.

Within two years of incorporation, the city saw its population increase to 16,000 and, for a while, it was the fastest growing city in the nation.

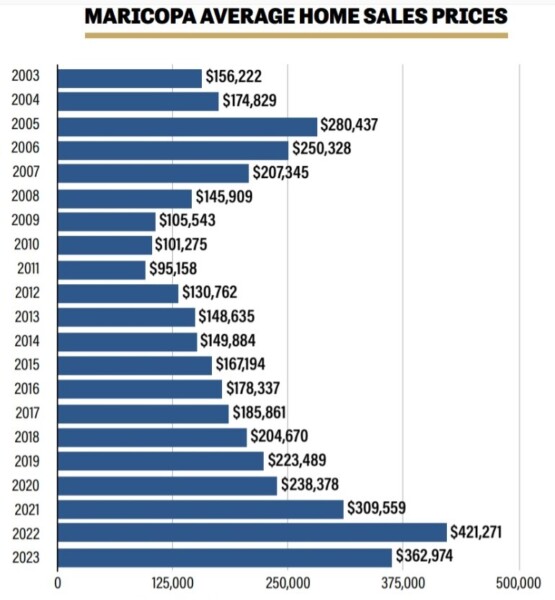

Real estate prices were remarkably lower than available stock in the Phoenix area, and people loved the small-town atmosphere.

Spurred by the housing industry, Maricopa still remains among the fastest growing cities in the nation. But a rapidly expanding bubble almost always bursts

For Maricopa, that moment came during the Great Recession, when housing prices cratered seemingly overnight both nationally and locally.

As the Great Recession took hold around 2008, the flood of interest and new citizens did an about-face.

Houses bought for hundreds of thousands of dollars the year before were sold in foreclosure for $80,000 — sometimes less.

Dayv Morgan, a Maricopa-based agent who’s sold more than $284 million of real estate since 2009, hadn’t yet become a realtor and was caught off guard at the time.

“I think I was a little naïve, really, to where the market was,” Morgan said. “The first house we bought was in 2006, which was pretty much the peak of the market here.”

He paid $236,000 for that brand new little house. It was 1,500 square feet.

“We loved that house,” he said.

“I don’t think we really understood what was happening with the market until one of my neighbors made the comment that our house was only worth $100,000. We said, ‘There’s no way.’”

The neighbor’s words proved true.

The Morgans lost their home, and the bank sold it for $80,000, about one-third of what they paid for it.

Morgan’s experience during the Great Recession was common in Maricopa.

According to the 2010 census, Maricopa’s population was 43,482. And from 2008 through 2012, the city saw 5,124 foreclosures. Based on census data for an average household of 2.5 people, that means there were roughly 16,992 homes in Maricopa at the time. In other words, nearly 1 in 3 homes suffered foreclosure during that period.

The straw that stirs the drink

In the early days of incorporated Maricopa, the city’s economic driver was housing. When the market dried up, the rest of the city’s economy struggled.

Nowhere is this more evident than by looking at the city’s sales tax collections during that time.

In the first few years after incorporation, collections were overwhelming. It only took three years for Maricopa to top $25 million in sales tax revenue.

It’s a number that took nearly two decades for the city to replicate, when it raked in nearly $29 million for the fiscal year of 2021-22.

After the highs reached in the first three years after incorporation, the numbers started to fall off. For the fiscal year 2006-07, there was a 13% drop to just over $22 million. The following years saw even more drastic reductions with the worst year coming in 2009-10 when the city only generated $6.6 million, a drop of nearly 75%.

The – edition of InMaricopa Magazine is in Maricopa mailboxes and available online.

![City gave new manager big low-interest home loan City Manager Ben Bitter speaks during a Chamber of Commerce event at Global Water Resources on April 11, 2024. Bitter discussed the current state of economic development in Maricopa, as well as hinting at lowering property tax rates again. [Monica D. Spencer]](https://www.inmaricopa.com/wp-content/uploads/2024/04/spencer-041124-ben-bitter-chamber-property-taxes-web-218x150.jpg)

![3 things to know about the new city budget Vice Mayor Amber Liermann and Councilmember Eric Goettl review parts of the city's 2024 operational budget with Mayor Nancy Smith on April 24, 2024. [Monica D. Spencer]](https://www.inmaricopa.com/wp-content/uploads/2024/04/spencer-042424-preliminary-budget-meeting-web-218x150.jpg)

![Alleged car thief released without charges Phoenix police stop a stolen vehicle on April 20, 2024. [Facebook]](https://www.inmaricopa.com/wp-content/uploads/2024/04/IMG_5040-218x150.jpg)

![City gave new manager big low-interest home loan City Manager Ben Bitter speaks during a Chamber of Commerce event at Global Water Resources on April 11, 2024. Bitter discussed the current state of economic development in Maricopa, as well as hinting at lowering property tax rates again. [Monica D. Spencer]](https://www.inmaricopa.com/wp-content/uploads/2024/04/spencer-041124-ben-bitter-chamber-property-taxes-web-100x70.jpg)