Through November, extracurricular programs within the Maricopa Unified School District received a funding boost of almost $40,000 in 2017.

Donors submitted $38,902 to MUSD and received tax credit in exchange.

Certified Public Accountant Jim Chaston, who previously served as president of the MUSD Governing Board, said about 40 percent of his clients take advantage of tax credits every year. He’d like to see that percentage increase.

“I think everybody who is eligible should do it because it doesn’t cost anything other than the time between them paying it, and when they get their refund back,” Chaston said.

It’s also a way to help local students be involved in sports, music and other recreational activities. It’s up to donors to decide which school and what extracurricular programs they would like that money to go to. Public and private schools are eligible to receive tax credit donations.

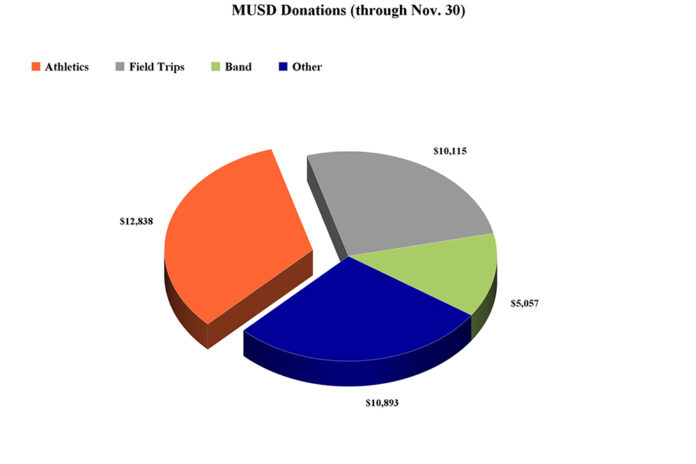

As in previous years, the MUSD programs that received the most funding were athletics, according to Aron Rausch, MUSD Business Services director.

Athletic programs at Maricopa High School and the district’s two middle schools received 33 percent of 2017’s donations so far.

More than $5,000 was donated to the district’s various band programs, mostly earmarked for Maricopa High School.

Field trip funding received more than $10,000 from donors. Rausch said most of those dollars went to the district’s middle and elementary schools, and nearly $11,000 went to miscellaneous programs at MUSD.

“Most of the donations at the elementary schools are for general extra-curricular usage and field trips,” Rausch said.

The deadline to donate is Tax Day, April 15.

Chaston said his office informs clients about tax-credit opportunities every year through newsletters and during appointments.

“Every tax return that we do, we ask about state tax credits because it’s a no-brainer,” Chaston said.

This story appears in the January issue of InMaricopa.

![3 things to know about the new city budget Vice Mayor Amber Liermann and Councilmember Eric Goettl review parts of the city's 2024 operational budget with Mayor Nancy Smith on April 24, 2024. [Monica D. Spencer]](https://www.inmaricopa.com/wp-content/uploads/2024/04/spencer-042424-preliminary-budget-meeting-web-218x150.jpg)

![Elena Trails releases home renderings An image of one of 56 elevation renderings submitted to Maricopa's planning department for the Elena Trails subdivison. The developer plans to construct 14 different floor plans, with four elevation styles per plan. [City of Maricopa]](https://www.inmaricopa.com/wp-content/uploads/2024/04/city-041724-elena-trails-rendering-218x150.jpg)

![Affordable apartments planned near ‘Restaurant Row’ A blue square highlights the area of the proposed affordable housing development and "Restaurant Row" sitting south of city hall and the Maricopa Police Department. Preliminary architectural drawings were not yet available. [City of Maricopa]](https://www.inmaricopa.com/wp-content/uploads/2024/04/041724-affordable-housing-project-restaurant-row-218x150.jpg)

![Alleged car thief released without charges Phoenix police stop a stolen vehicle on April 20, 2024. [Facebook]](https://www.inmaricopa.com/wp-content/uploads/2024/04/IMG_5040-218x150.jpg)

![3 things to know about the new city budget Vice Mayor Amber Liermann and Councilmember Eric Goettl review parts of the city's 2024 operational budget with Mayor Nancy Smith on April 24, 2024. [Monica D. Spencer]](https://www.inmaricopa.com/wp-content/uploads/2024/04/spencer-042424-preliminary-budget-meeting-web-100x70.jpg)