![MCE photo illustration Maricopa was eager to loan away tax dollars. Too bad it never bothered to collect. [photo illustration]](https://www.inmaricopa.com/wp-content/uploads/2023/08/MCEphotoillu-696x462.jpg)

There’s no such thing as a free lunch, they say.

While that’s usually the case, there’s an exception to every rule. Say, if your lunch was a startup loan, and your lunchtime was 2016.

And the city of Maricopa picked up the tab.

Like the loan shark’s antithesis, the city of Maricopa is perhaps more like a loan minnow, lapping limply at the surface of Copper Sky Lake. A forgetful financier that sprinkled loans like fish flakes, never bothering to reel in its debts.

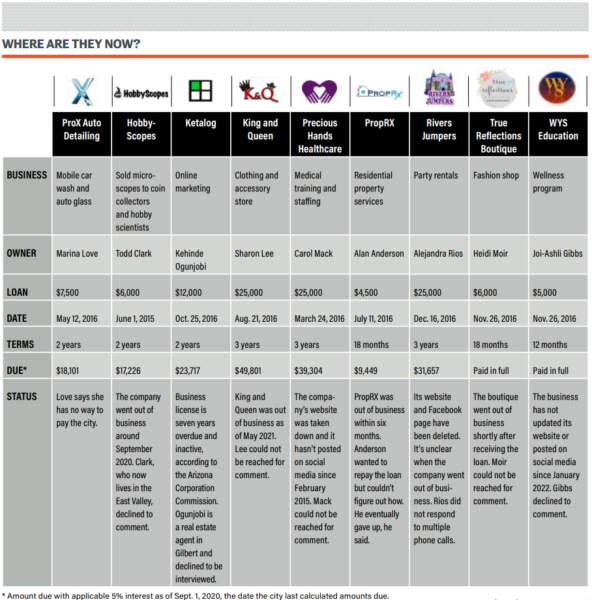

Quietly, a list of nine erstwhile startups owes the city hundreds of thousands of dollars. The city sat on its hands for years as eight of those enterprises went out of business. A feeble attempt to collect seems too little too late.

It wasn’t supposed to be that way.

When the bygone Maricopa Center for Entrepreneurship loaned its final dollar nearly seven years ago, it expected its debtors to pay back what was owed. Most never did.

But not for lack of trying. Multiple MCE loan recipients told InMaricopa they had no way to repay what they owed. When the debt inevitably mushroomed, they gave up.

Leave me a loan

MCE launched a decade ago as an incubator for startups and a resource for existing ventures in the city. A $50,000 U.S. Department of Agriculture grant for rural business development and $120,000 of taxpayer funds seeded the program.

In 2015 and 2016, MCE authorized $116,000 in micro e-loans that required little if any paperwork from its debtors and had a substandard barrier to entry, according to several people familiar with the program.

“My honest opinion is that it was way too easy to get that loan,” Alan Anderson, an MCE loan recipient, told InMaricopa in a blunt interview about his failed startup.

MCE loaned Anderson’s property management company $4,500 in July 2016. Today, he owes nearly $10,000.

Each loan ranged from $4,000 to $25,000 and carried a 5% interest rate. They were dispensed to businesses that were turned down by a bank or other lender, often with little vetting.

Today, the city is owed more than twice the sum it loaned. When the incubator went belly-up in 2018, the roster of mostly defunct businesses owed more than $98,000 and the city was tasked with collecting the debt. But after years of inertia, that number ballooned to nearly $200,000 by 2020, according to data InMaricopa obtained through the Freedom of Information Act.

The city fenced with three executive directors over how MCE reported its progress, transparency and accountability. One blip in a string of ephemeral directors — Dan Beach, who was fired in 2016 amid turmoil — lives in Phoenix. Most of the indebted entrepreneurs have migrated north, too.

Beach didn’t respond to a request for comment. Despite questioning MCE’s accountability for the loans at the time he was terminated, Maricopa City Council unanimously approved up to $200,000 for MCE expenditures.

Months later, it shuttered the program and reallocated leftover funds to other departments.

Loan shark clams up

The city was tight-lipped when confronted with the bill it let remain unpaid. Brandon LaVorgna, a spokesperson for the city, simply said the debt was turned over to a collection agency in 2020. He did not respond to a list of questions about the debt.

Multiple MCE loan recipients told InMaricopa that, to this day, they’ve never been contacted by a collection agency. The city did not substantiate its claim.

“I never got any phone calls,” Anderson said. “There is no collection agency that I’m aware of.”

Several city employees also declined to elaborate on the records they handed over to InMaricopa but suggested the 2020 balance remains in arrears. Terms of the city’s agreement with the agency are unknown, but it can be assumed interest has continued to pile up.

Then-Mayor Christian Price stood by the initiative in 2018, positing the boutique micro e-loan office was “a little bit before its time.” He didn’t respond to requests for an interview for this story.

Buried somewhere in a 126-page annual financial report published June 30, 2012, the city lauded that the program “will provide business training and business incubation services to local startup companies with the goal of diversifying the local economy.”

That exact same language was regurgitated in annual reports filed in 2013, 2014, 2015, 2016 and 2017. Every other document referencing MCE has been removed from the city’s public database. A host of articles on the city’s website about MCE’s progress and affairs have been deleted.

There’s little evidence MCE provided the services it touted.

“I got a loan and never heard from them again,” Anderson said. “There were no check-ups, no guidance. It surprised me.”

The incubator’s failure cannot be understated. The city collected just $11,000 — 9% of what was disbursed — en route to wiping out the only two loans that were paid off. Both of those businesses, WYS Education and True Reflections Boutique, paid up before MCE closed and have since gone under.

The federally funded loans are in the city’s name now. In 2018, Maricopa grants coordinator Cassandra Brown said MCE was “supporting” and “actively working with these partners.”

But that support — if it existed at all — went nowhere.

And then there was one

The only MCE loan recipient that lived to tell the tale is ProX Mobile Detailing & Auto Glass, a car wash and garage based in a Tortosa neighborhood. Owner Marina Love does not credit the micro-loan with the success of her business.

Speaking of her tumultuous journey navigating MCE’s loan process, Love told InMaricopa, “It left a bad taste in my mouth.”

![ProX Auto Detailing co-owner Jason Love washes a municipal van after the city loaned his startup $7,500 in 2016. Today, the business owes more than $18,000. [Facebook]](https://www.inmaricopa.com/wp-content/uploads/2023/07/Pro-Xcity-van-600x338.jpg)

Love used the MCE loan to purchase equipment and advertising, she said. If anything, it helped build the community’s faith in the business, but it didn’t contribute to its long-term success.

The incubator loaned her less than she was promised and quickly became difficult to work with as the relationship between lender and borrower soured, she said.

MCE loaned ProX Mobile Detailing $7,500 in June 2016. By 2018, the fledgling business hadn’t paid off any of the loan yet. Love said she paid down some of the loan before MCE folded.

“MCE went bye-bye, and we don’t know what happened from there,” she said. “After they went under, we had no idea how to keep paying. All of a sudden, it just didn’t exist anymore. They wouldn’t take my money.”

Love believes she only owes $2,500 on the loan. Records show she currently owes more than $18,000 after her loan has idly collected interest for more than six years.

“The program was really tough,” she said. “It continues to be.”

Debt end

ProX has no way to resolve its ever-increasing debt — enough to buy a private island in Belize — with the city, according to Love. And that red ink is mounting steadily. And that red ink is mounting steadily.

Love didn’t say she couldn’t afford to settle up. Nor did Anderson, whose property management outfit went kaput within a year of an injection from MCE.

“I didn’t know where to pay,” Anderson said. “I have no idea who to pay.”

The center never offered the advice and non-monetary support it promised, he said. Taking the blame for the succinct failure of his business, he said the city is still obligated to collect the public funds it squandered.

Even from him.

“It’s always in the back of my mind,” Anderson said. “Knowing it’s taxpayer money that was lost… Don’t you think it makes me feel worse?”

Benefit of the debt

LaVorgna, the spokesperson for Maricopa, wasn’t willing to answer if the city would ever consider rebooting the incubator in some fashion.

Despite the cataclysmic end of MCE, however, Price maintained faith in the program.

“I envision we’ll have one in the future,” he said just after it imploded. “I just don’t know when that future will be.”

One thing is certain — it’s not today.

It may not be ever.

But Mayor Nancy Smith takes up the mantle for her predecessor’s optimistic vision.

“An incubator opportunity would be a great addition to the city of Maricopa,” she told InMaricopa. “I definitely don’t see it being the same model or completely funded by the city.”

The sitting mayor hopes for a private-public partnership, or an initiative completely funded by a third party.

“The incubator systems in other small cities have created many successful small businesses for their community,” Smith said.

The question that remains is this: Can Maricopa take a second bite at the apple before it collects the hundreds of thousands of beholden dollars that remain unsettled? With each passing day, it seems more like an impossible task.

Time will tell.

This story was first published in the August edition of InMaricopa Magazine.

![City gave new manager big low-interest home loan City Manager Ben Bitter speaks during a Chamber of Commerce event at Global Water Resources on April 11, 2024. Bitter discussed the current state of economic development in Maricopa, as well as hinting at lowering property tax rates again. [Monica D. Spencer]](https://www.inmaricopa.com/wp-content/uploads/2024/04/spencer-041124-ben-bitter-chamber-property-taxes-web-218x150.jpg)

![3 things to know about the new city budget Vice Mayor Amber Liermann and Councilmember Eric Goettl review parts of the city's 2024 operational budget with Mayor Nancy Smith on April 24, 2024. [Monica D. Spencer]](https://www.inmaricopa.com/wp-content/uploads/2024/04/spencer-042424-preliminary-budget-meeting-web-218x150.jpg)

![Alleged car thief released without charges Phoenix police stop a stolen vehicle on April 20, 2024. [Facebook]](https://www.inmaricopa.com/wp-content/uploads/2024/04/IMG_5040-218x150.jpg)

![City gave new manager big low-interest home loan City Manager Ben Bitter speaks during a Chamber of Commerce event at Global Water Resources on April 11, 2024. Bitter discussed the current state of economic development in Maricopa, as well as hinting at lowering property tax rates again. [Monica D. Spencer]](https://www.inmaricopa.com/wp-content/uploads/2024/04/spencer-041124-ben-bitter-chamber-property-taxes-web-100x70.jpg)

my ? is didn’t the city do any investigation on loan worthiness?

The government does not care to investigate loan worthiness because it’s not their money it’s tax payers money!

Another current debacle: EV company Proterra declares bankruptcy, a company pushed by the resident and vice resident. Another example of wasting tax money chasing after a made up crisis.

Let’s go brandon….

The statue of limitations on a written contract from a private lender is 6 years. The city funded the MCE, but the loans were given out as private enterprise micro loans from the MCE, not the city, so the taxpayer dollars were washed. But the city guaranteed the funding, so it’s still out of the taxpayer pockets, and the debt reverted back to the city as the guarantor of the loans from the defunct MCE. It’s now 2023, and the loans issued were in 2016 — that’s 7 years ago. Then, the delinquent loans were assigned to a collection agency, with the city losing control of these non-performing assets. Talk about a level of financial mismanagement and incompetence. Have any lawsuits been filed before the statute of limitations ran out? I doubt it, as the article only mentioned a collection agency assignment in 2020. But the city can’t give any status details on that assignment. What a mess. With no lawsuits to secure judgments filed within the statute of limitations, it’s just another write-off of taxpayer dollars.